Media

WE ADDED DOGE TO OUR DATA SUITE

October 7th, 2025

DOGE data has been processed and is now available on our platform

Read More

WE ADDED BITCOIN TO OUR DATA SUITE

October 6th, 2025

BITCOIN data has been processed and is now available on our platform

Read More

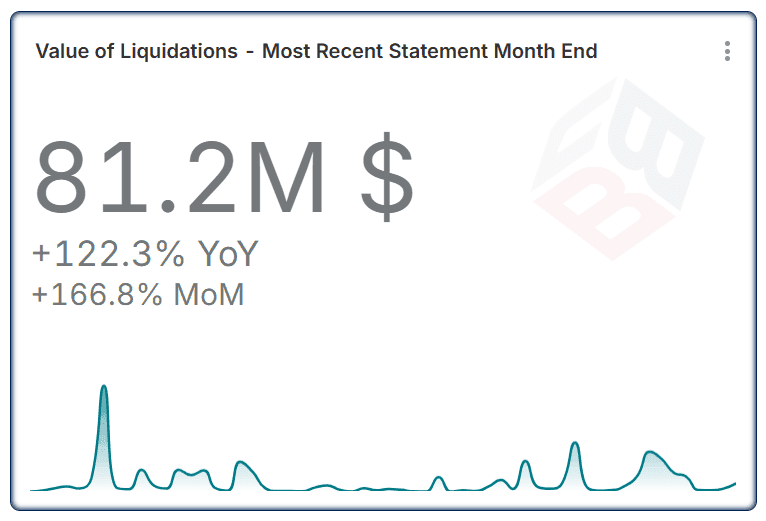

Loan Liquidations Surge to $81.2M

September 19th, 2025

Loan liquidations increased +167% month-on-month to $ 81.2m.

Read More

Blockchain Wallets: Scale, Activity, and Adoption Potential

September 10th, 2025

2.2B Blockchain wallets: 87.5% hold <$1, 30% active yearly

Read More

The Power of Onchain BOTS

September 4th, 2025

Driving $1.7T in Transactions with Just 0.18% of Accounts!

Read More

INTRODUCING THE TOKEN SAFETY ORACLE (TSO)

August 26th, 2025

DYOR with simplified token fundamentals.

Read More

OUR STABLECOINS DASHBOARD IS LIVE!

July 29th, 2025

Visualize Stablecoin markets, Flows, Risks, and Blacklisted activity.

Read More

SuisseBase Empowers Customers With Simplified Data

July 14th, 2025

Suissebase sets new standard with Providence integration.

Read More

OUR TRIGGERS & ALERTS SERVICE IS LIVE!

July 10th, 2025

Turn onchain events into profitable actions

Read More

Unlock the Power of Your Customer Data with Blockchain Bureau

July 3rd, 2025

Blockchain-based businesses can now access multichain customer data in bulk

Read More

Blacklisted Stablecoin Funds

May 20th, 2025

Over $510M in blacklisted stablecoins destroyed since 2019

Read More

Highest TPS by Chain Recorded on EVM Ever

May 8th, 2025

Sonic blockchain hit 1,097 TPS on May 7, 2025, 2nd highest EVM record.

Read More

Investment Performance - Last 2 Years

April 11th, 2025

The explosive growth in onchain activity over the past two years

Read More

Is DeFi Cheaper than TradFi?

April 8th, 2025

DeFi is cheaper than TradFi: lower rates (11% vs 17% APR), no fees.

Read More

ANNOUNCEMENT | BCB ADDS SILO V2 TO ITS CREDIT DATA SUITE

March 28th, 2025

Silo Finance data has been processed and is now available on our platform

Read More

ANNOUNCEMENT | BCB ADDS SONIC TO ITS DATA SUITE

March 18th, 2025

SonicLabs's data has been processed and is now available on our platform!

Read More

Lending Market Share by Chain - 24 Months

March 17th, 2025

BASE now leads the lending market with a 40% share in Feb 2025.

Read More

Massive Growth in On-Chain Borrowers (+162%)

March 17th, 2025

The total number of borrowers surged 162% year-over-year over the last 2 years.

Read More

Our Blacklisting Service is Live!

March 11th, 2025

Add scammer addresses to bureau's illicit DB via FAFO.

Read More

Credit Risk: Stablecoin vs Memecoin Holders

February 17th, 2025

Holding over 50% in meme coins poses higher credit risk than stablecoins.

Read More

Thin File Population by Chain

February 13th, 2025

"Thin File" users have limited transaction data for a reliable credit score.

Read More

Average Credit Score by Chain

February 12th, 2025

Avg. on-chain credit score is 617, with a 12.9% liquidation risk.

Read More

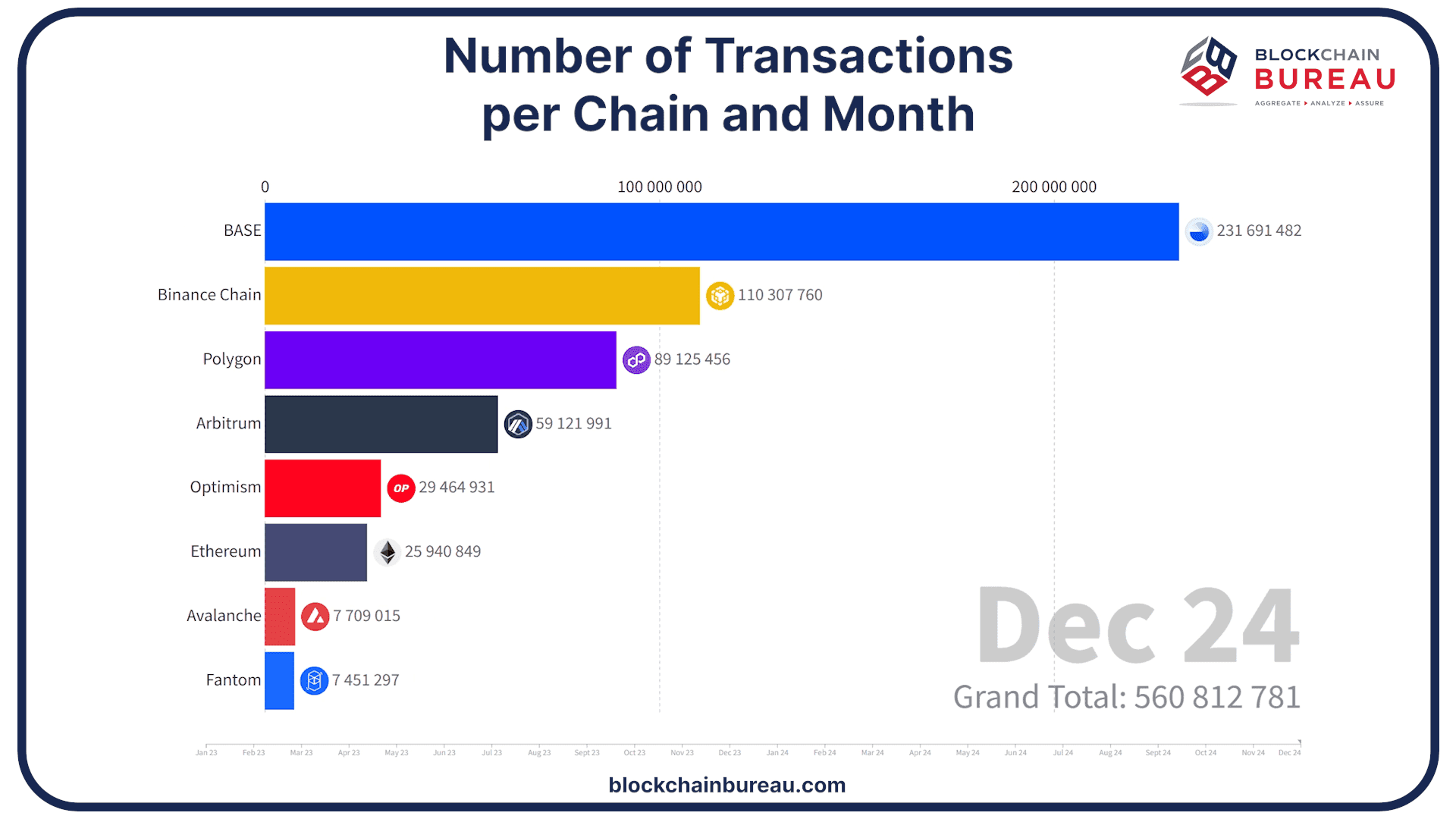

Number of Transactions per Chain and Month

January 29th, 2025

Blockchain is evolving fast, creating a global free market for open competition

Read More

Credit Score Distribution - Morpho vs Others

January 28th, 2025

Morpho users have a 551 avg score and 6.4% liquidation rate.

Read More

Total Outstanding Balance Morpho vs Industry as at Dec 2024

January 28th, 2025

On-chain lending grew in 2024, with Morpho closing the year at $1.4B in debt.

Read More

Liquidation Rate Morpho vs Industry - 2024

January 28th, 2025

In 2024, Morpho's liquidation rate was 6.4%, second-highest after Compound.

Read More

Average Utilization Morpho vs Industry

January 28th, 2025

Morpho's facility utilization is 61%, the highest among all protocols analyzed.

Read More

Morpho New Loans - 2024

January 28th, 2025

Morpho grew steadily in 2024, launching on ETH in January and BASE in May.

Read More

Morpho Average New Loan Value - 2024

January 28th, 2025

In 2024, Morpho's average loan value was $123,000, second-largest in lending.

Read More

ANNOUNCEMENT | BCB ADDS MORPHO TO ITS CREDIT DATA SUITE

January 28th, 2025

Morpho's data is now processed and available on our platform!

Read More

A Brief History of Credit

January 28th, 2025

In order to know where we are headed, we need to know where we come from.

Read More

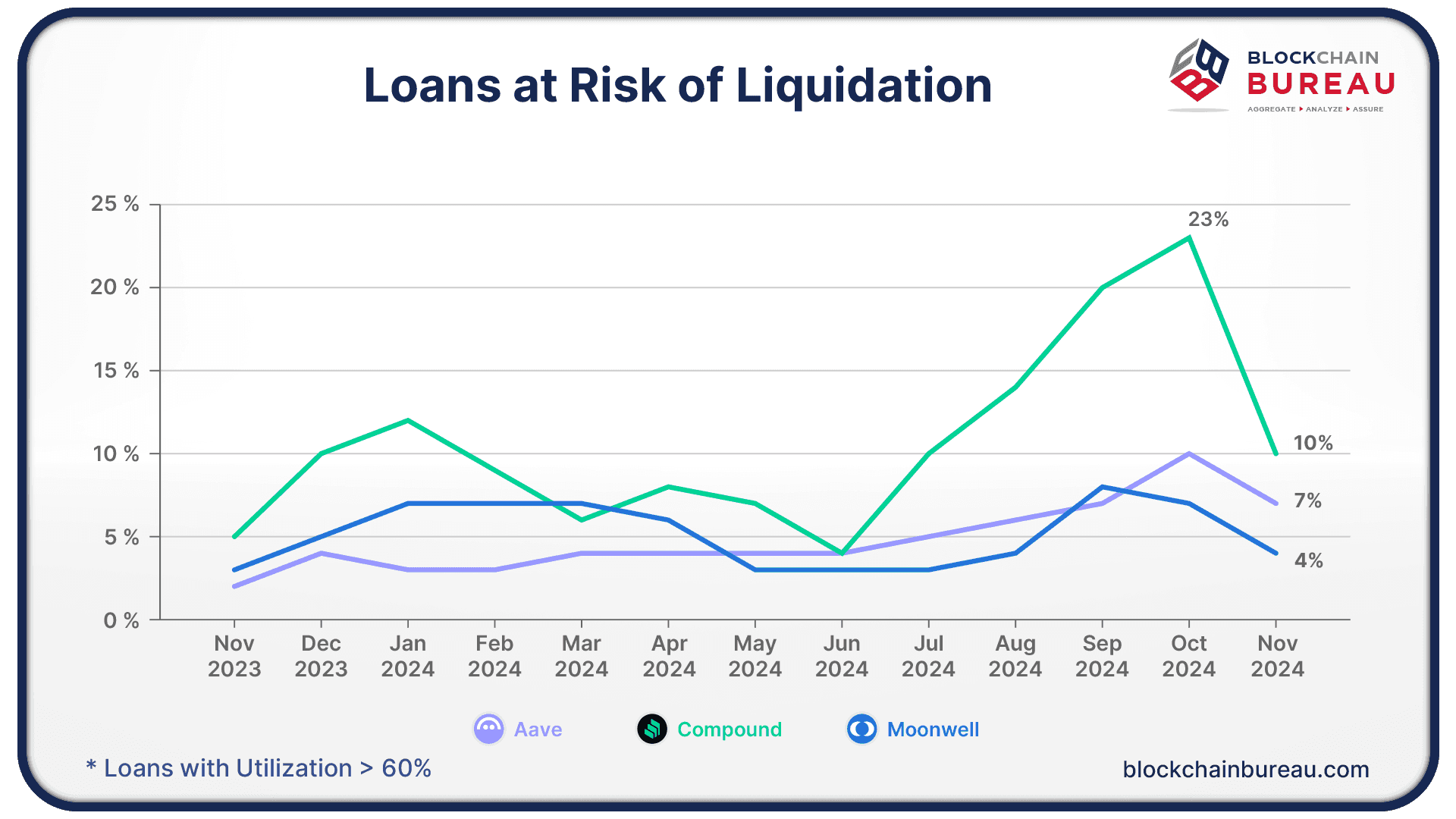

Loans at Risk of Liquidation on BASE

January 28th, 2025

Compound users show higher delinquency rates due to volatile collateral assets.

Read More

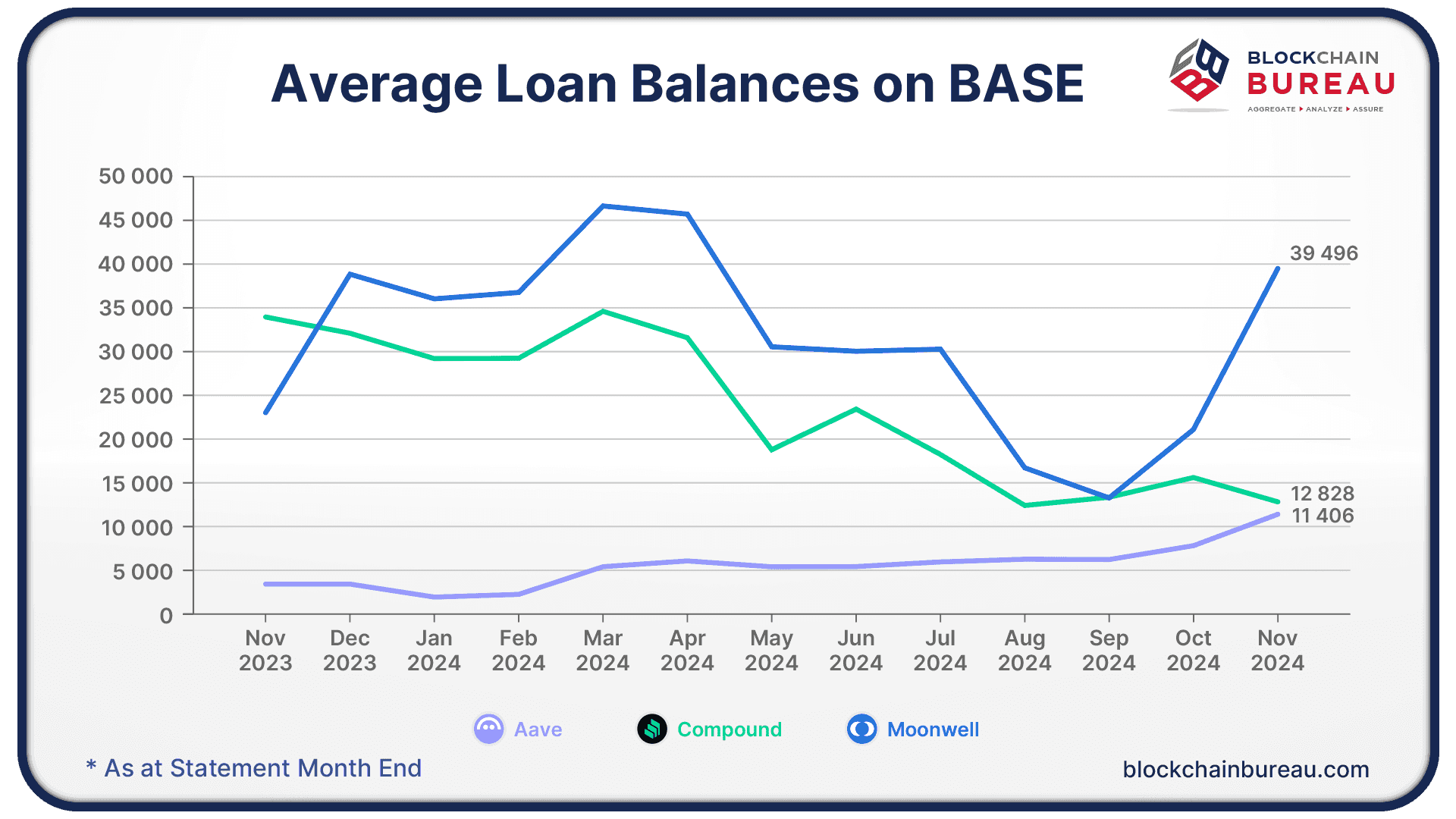

Average Loan Balances on BASE

January 28th, 2025

Average loan balances on BASE are $18K, about 61% lower than other EVM chains.

Read More

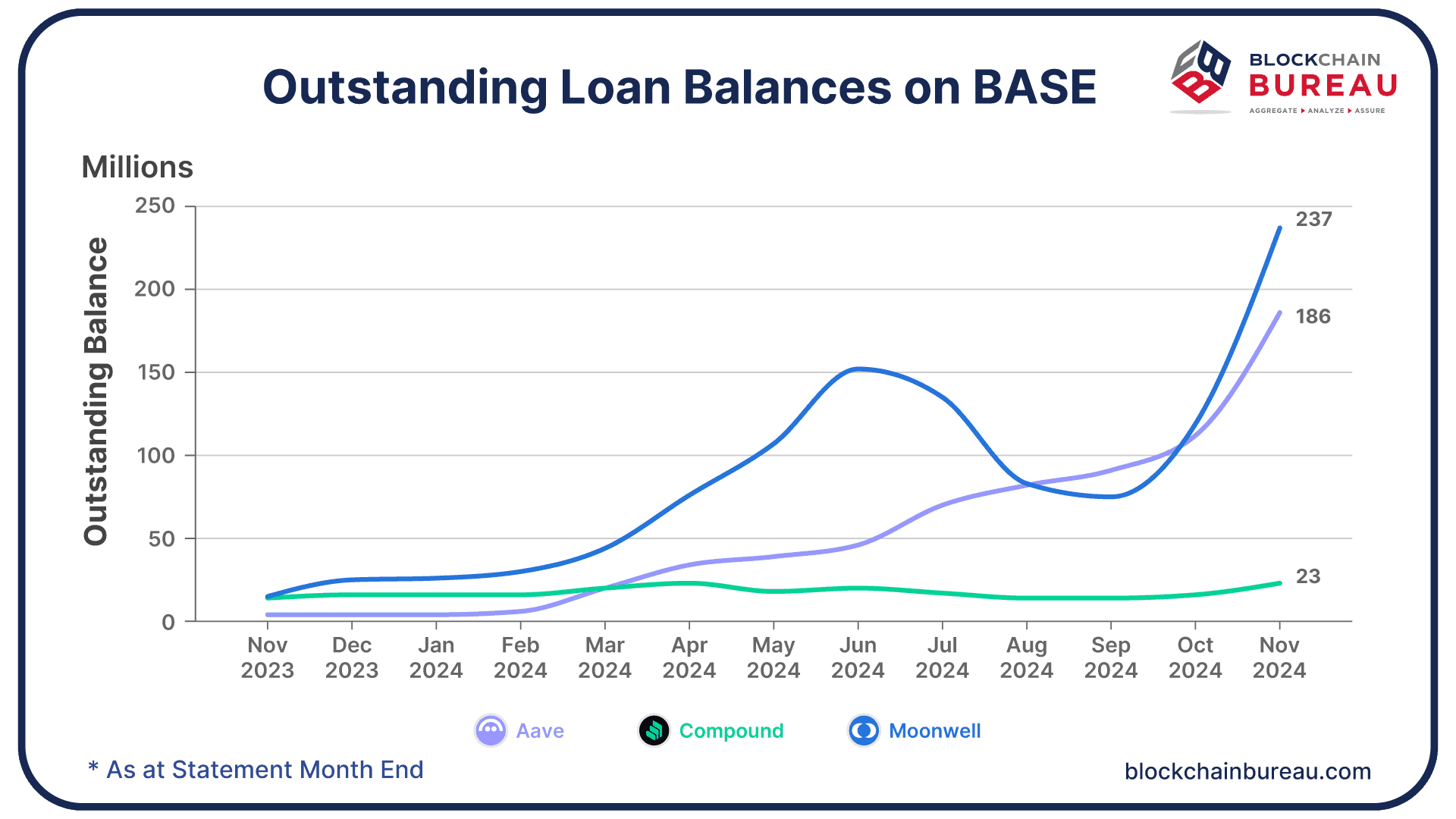

Loans on BASE

January 28th, 2025

Blockchain Bureau covers Aave, Moonwell, Compound, and soon Morpho on Base.

Read More

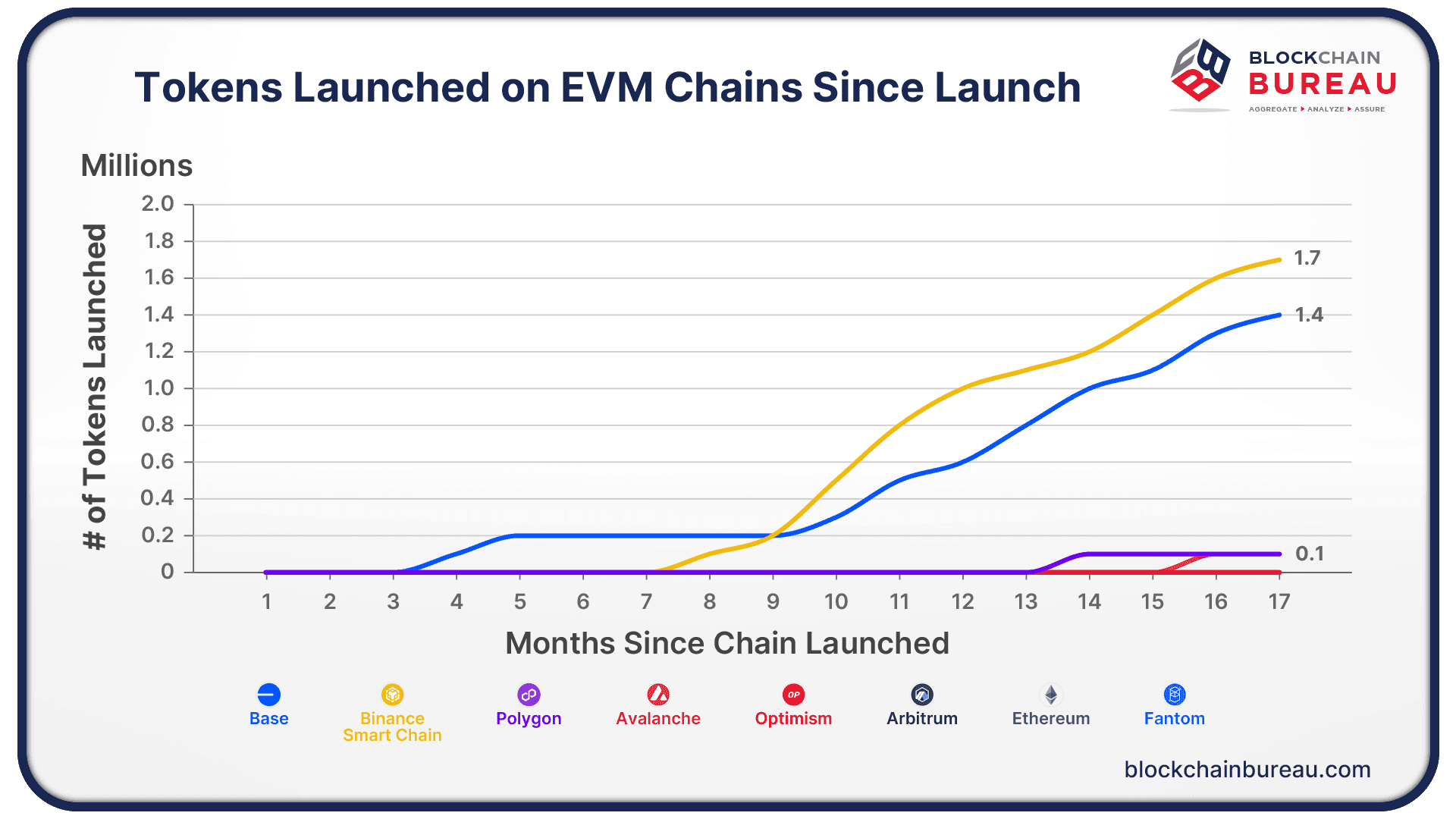

Tokens Launched on BASE

January 28th, 2025

By October 2024, tokens on BASE topped 1.4M, 17 months after mainnet launch.

Read More

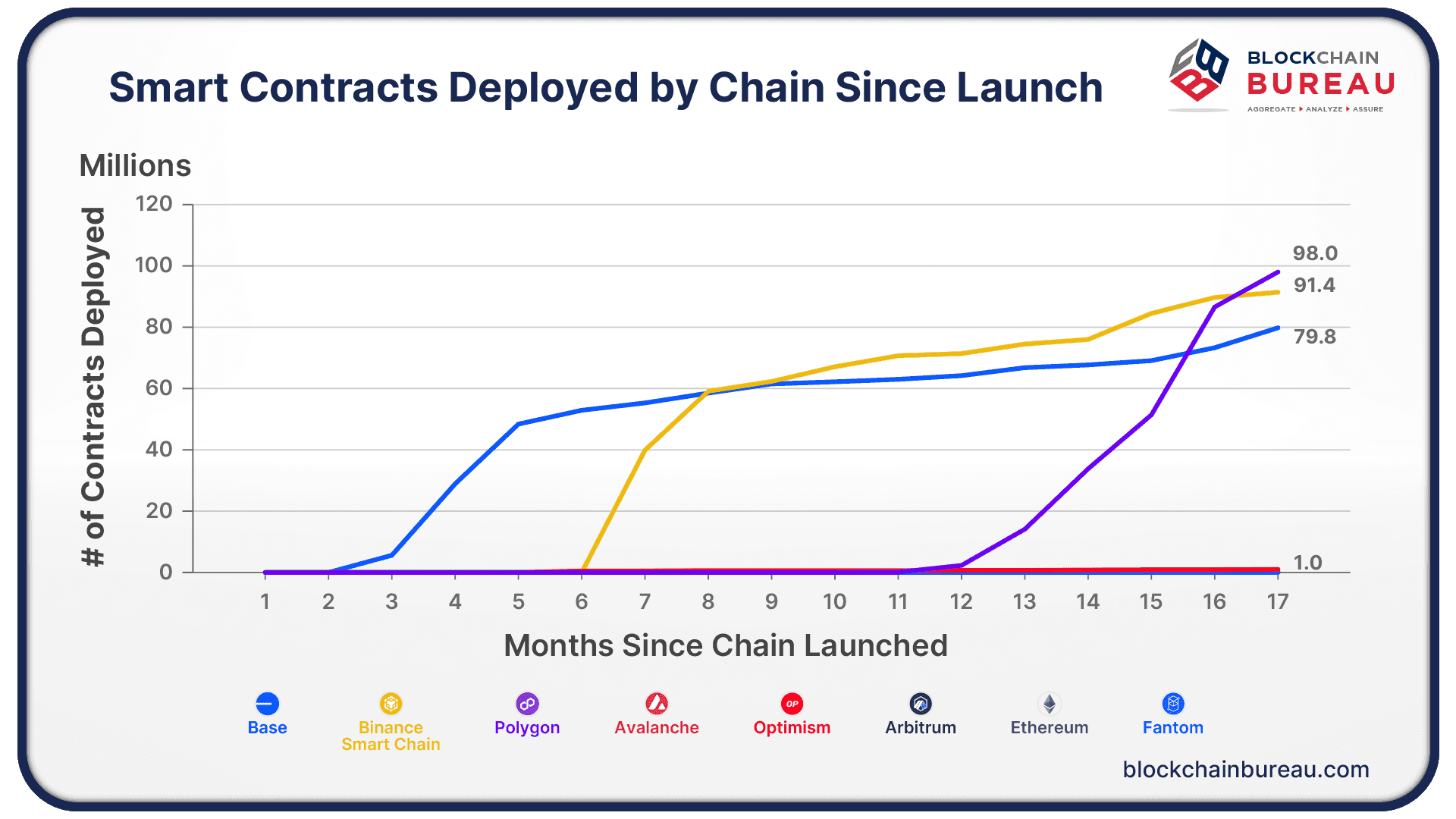

Smart Contracts Deployed on BASE

January 28th, 2025

By October, 80M contracts on BASE show activity rivaling BSC and Polygon.

Read More

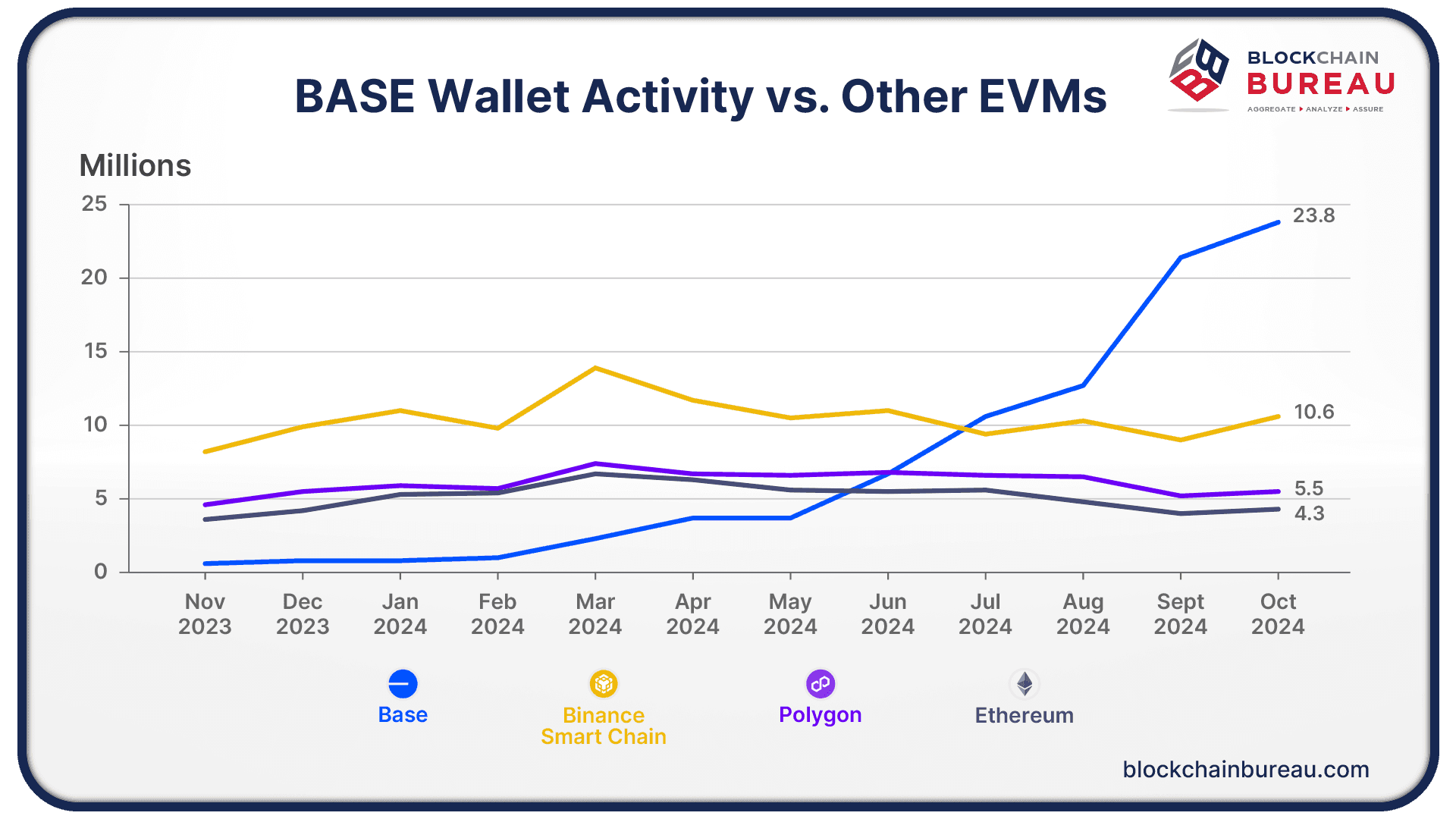

Wallet Activity on BASE Exceeds The Largest EVM Chains (Wallets Sending Funds)

January 28th, 2025

Wallet activity on BASE has surged since March 2024, surpassing top EVM chains.

Read More

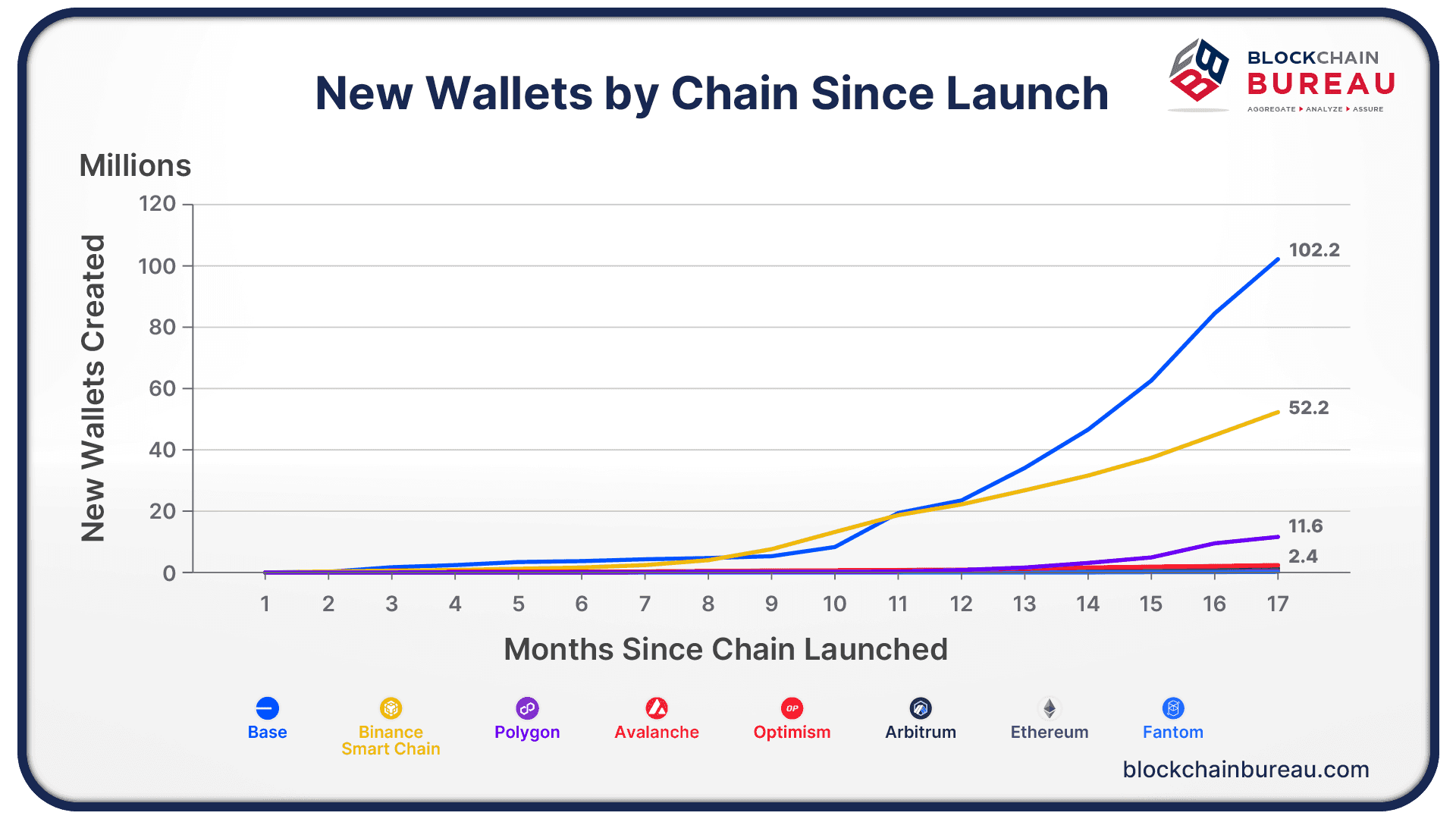

New Wallets Opened by Chain Since Launch

January 28th, 2025

New wallets on BASE outpaced all other EVM chains in their first 17 months.

Read More

ANNOUNCEMENT | BCB ADDS BASE TO ITS DATA SUITE

January 28th, 2025

We are delighted to announce that BASE's data is now available on our platform!

Read More

Why Multi-Chain Credit Scoring Is Important

November 20th, 2024

Credit scores vary by chain and protocol due to differing user behaviors.

Read More

Weekly Credit Score Shifts

November 15th, 2024

BCB's credit score distribution by band over the past three weeks.

Read More

Loan Roll Rates (Forward)

November 14th, 2024

By Oct '24, under 10% of loans moved to higher util amid a strong crypto market.

Read More

Loan "Delinquency" Distribution

November 9th, 2024

On-chain loans improved over 3 months, with fewer liquidations and lower usage.

Read More

High-Value Transactions of Stablecoins (> $10m)

October 28th, 2024

Through September, 54,141 high-value stablecoin transfers were on-chain.

Read More

Why Are Credit Scores So Important?

October 22nd, 2024

The graph shows our credit score effectively predicts liquidation likelihood

Read More

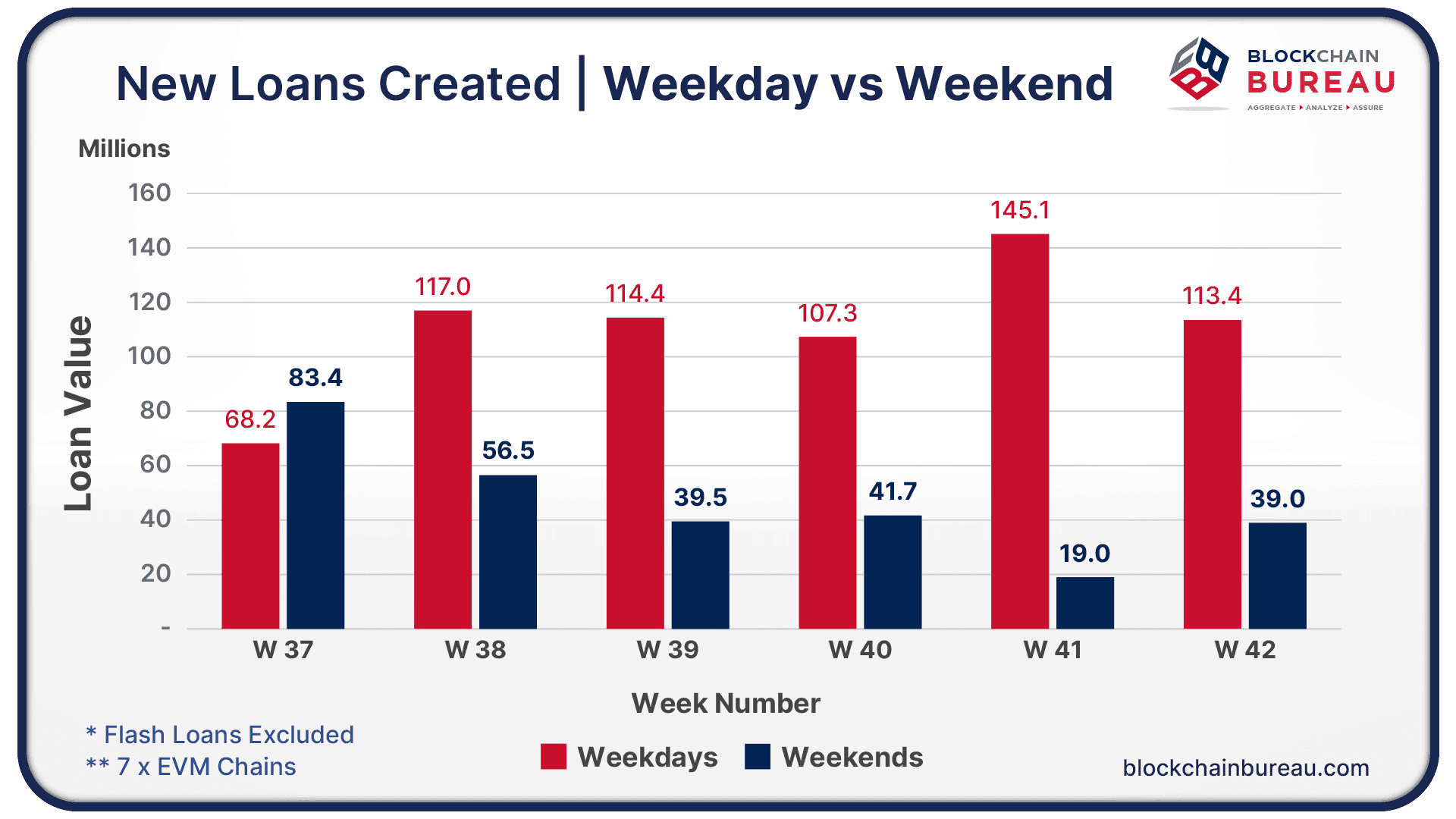

New Loans over Weekends

October 21st, 2024

Last weekend, with banks closed, $39m in new loans went to 744 wallets

Read More

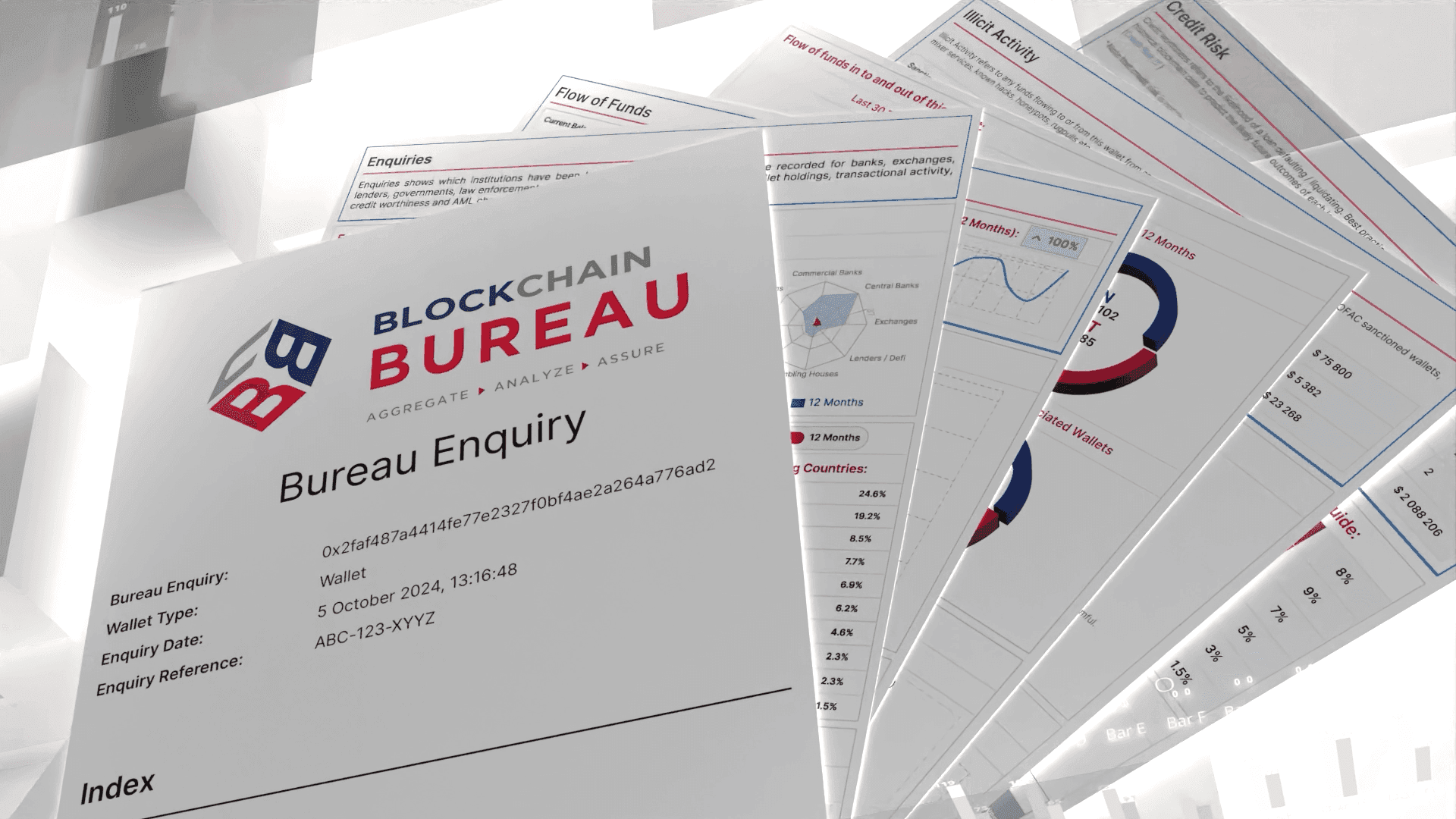

LAUNCHING OUR FLAGSHIP PRODUCT

October 15th, 2024

We are proud to launch "PROVIDENCE", our flagship product.

Read More

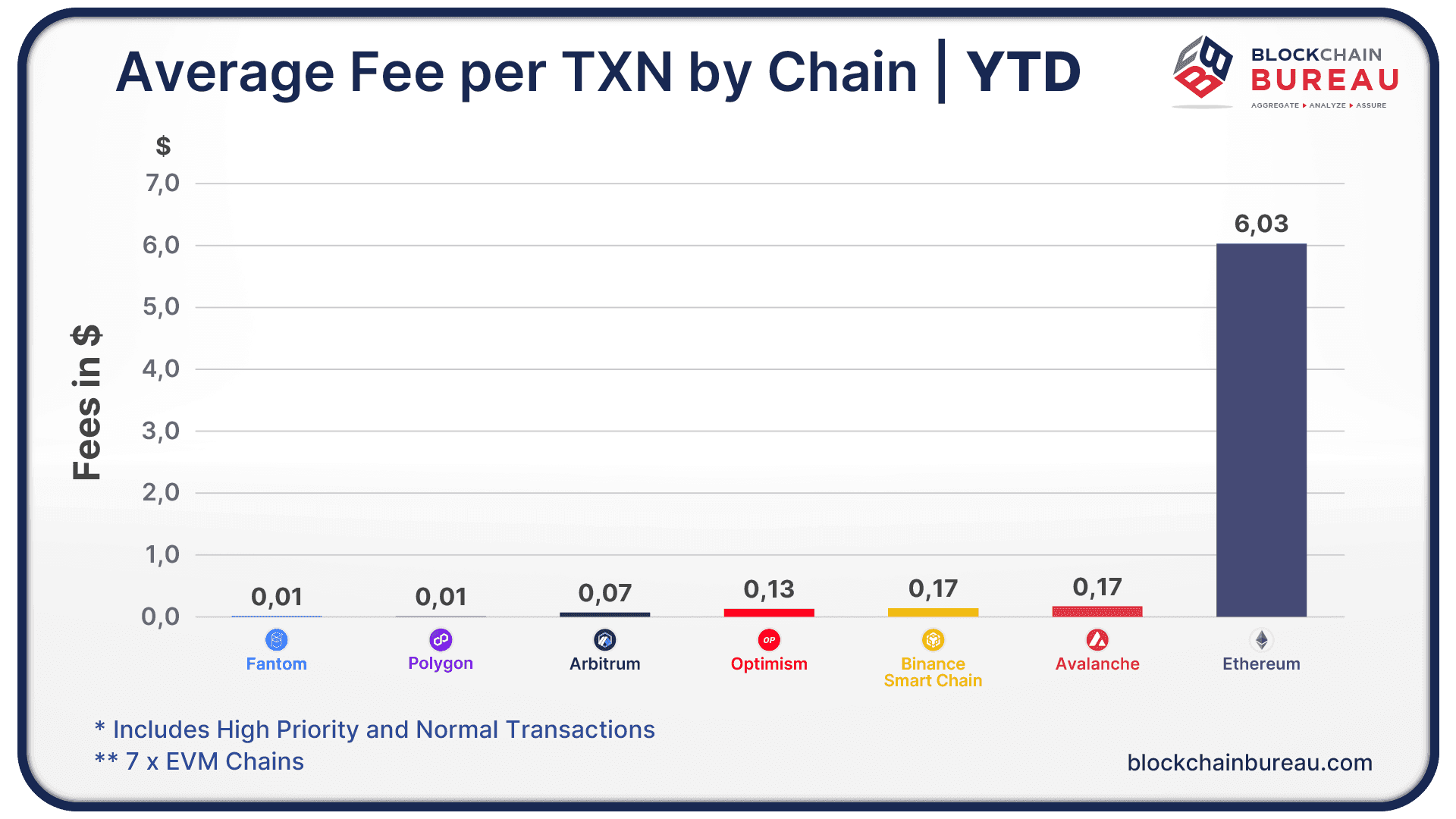

Transaction Fees (Gas) by Chain - YTD

October 3rd, 2024

The average transaction cost was $0.67 on EVM.

Read More

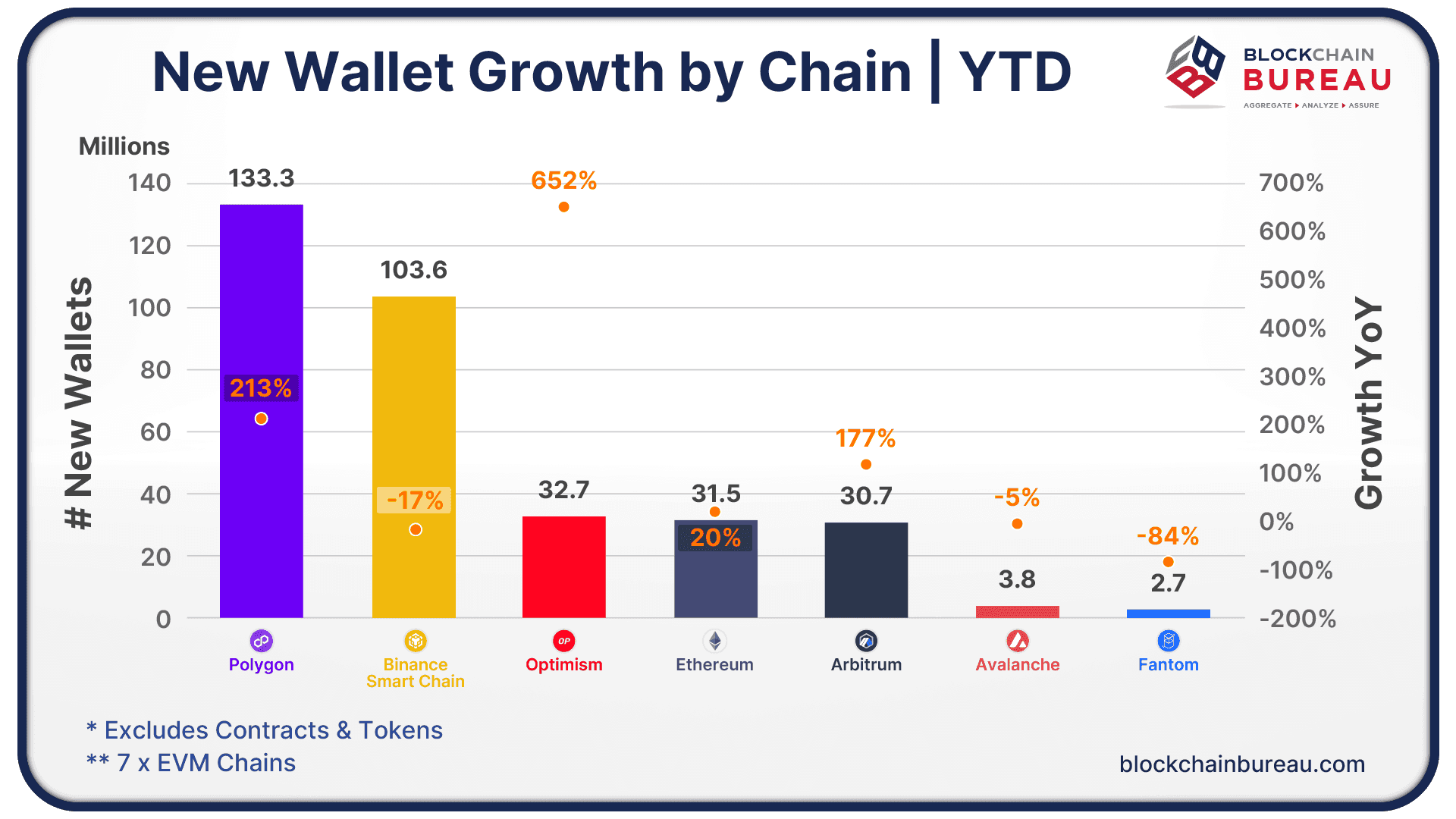

New Wallet Growth On-Chain | YTD

October 2nd, 2024

After 2024's first 3 quarters, the year is set for strong on-chain growth.

Read More

Which Assets are being borrowed On-Chain?

September 27th, 2024

Stablecoins are the most popular asset being borrowed on-chain during 2024

Read More

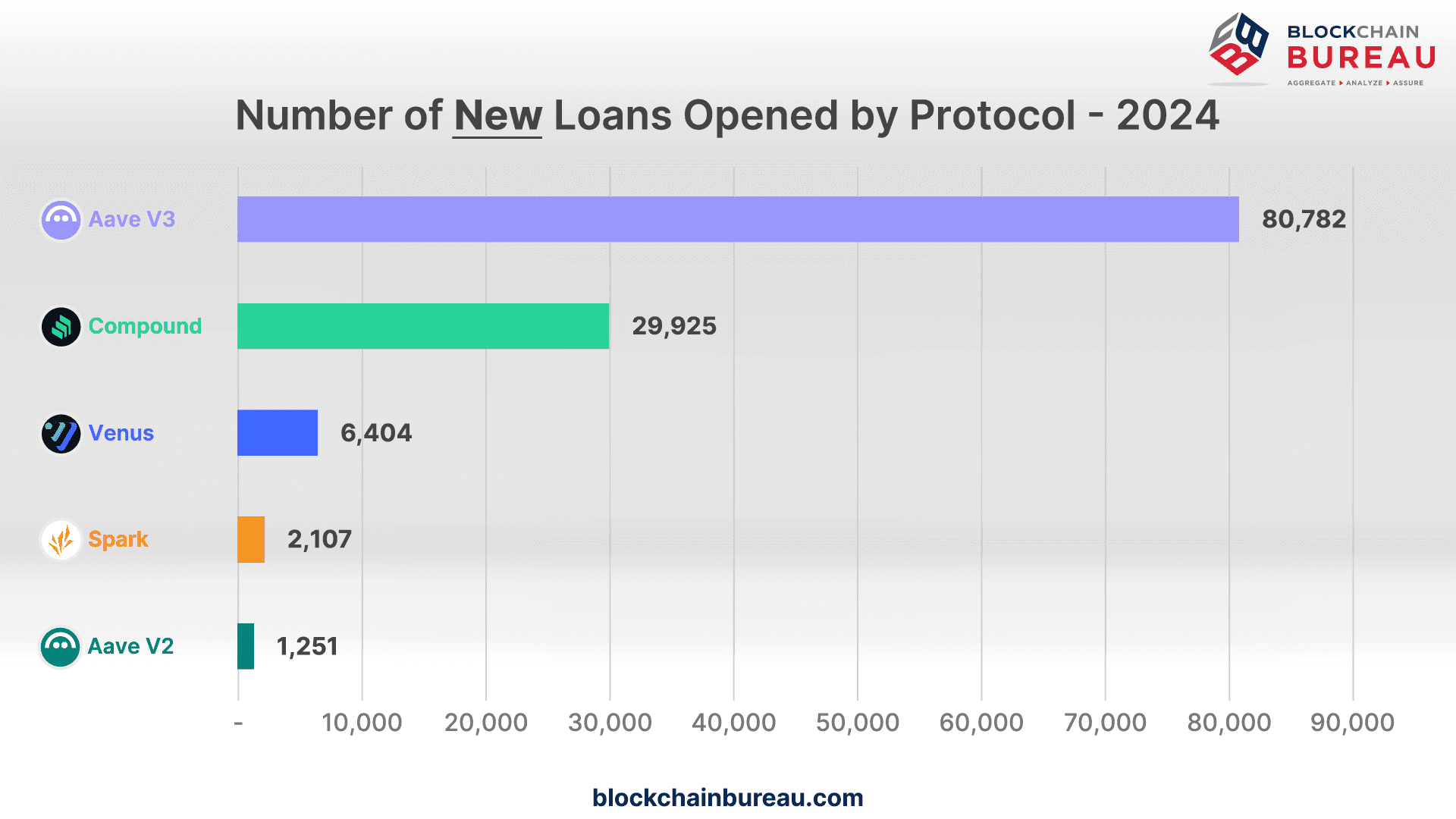

Number of New Loans Opened by Protocol - YTD

September 26th, 2024

Over 120k new loans granted on EVM by August, average loan value $48,000.

Read More

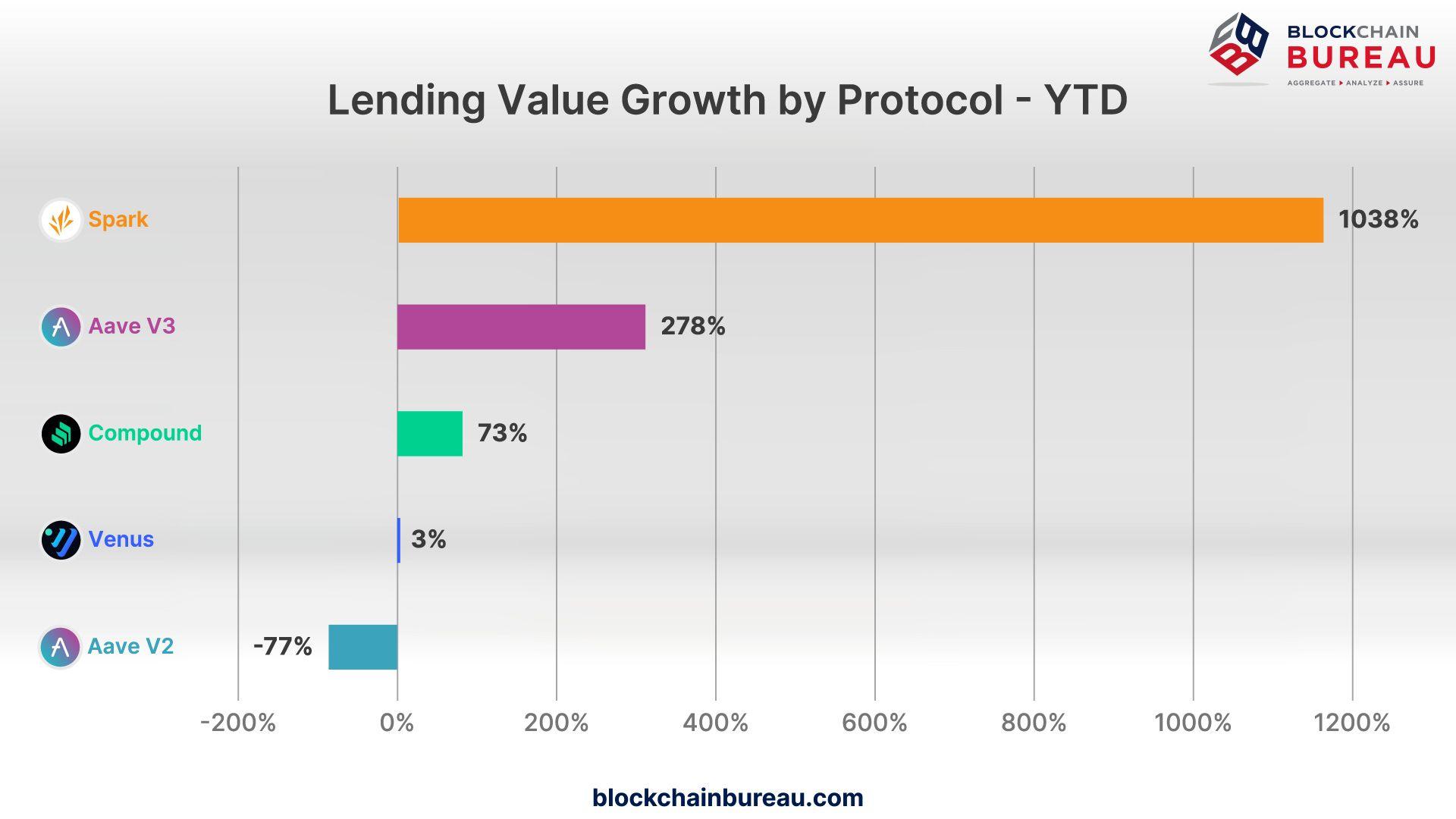

Lending Value Growth by Protocol - YTD

September 20th, 2024

$54B in loans YTD, 60% growth - DeFi lending market is booming!

Read More

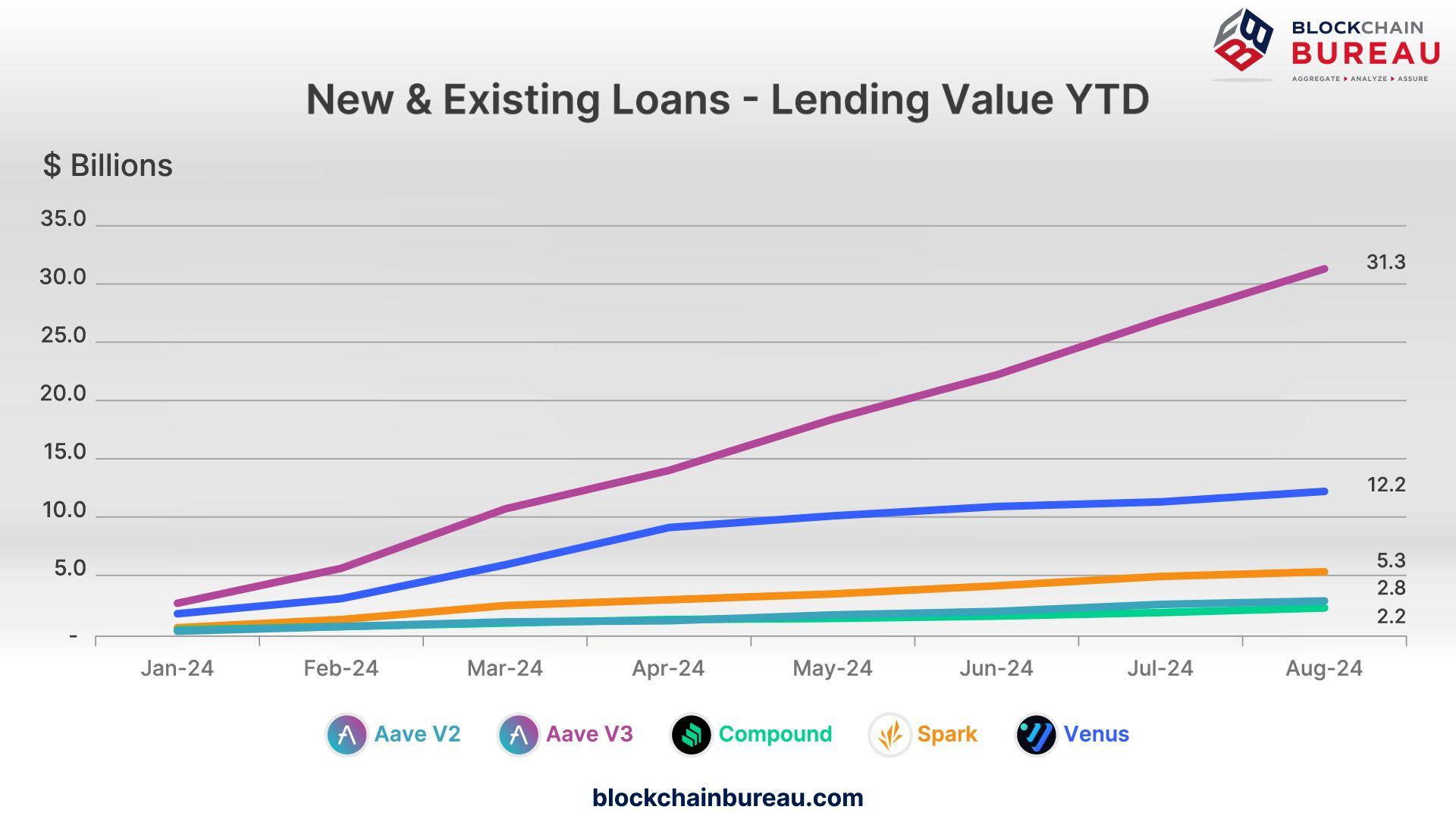

Top 5 Lenders On-Chain

September 20th, 2024

$54B borrowed year-to-date across top 5 on-chain lenders!

Read More