Loans at Risk of Liquidation on BASE

January 28th, 2025

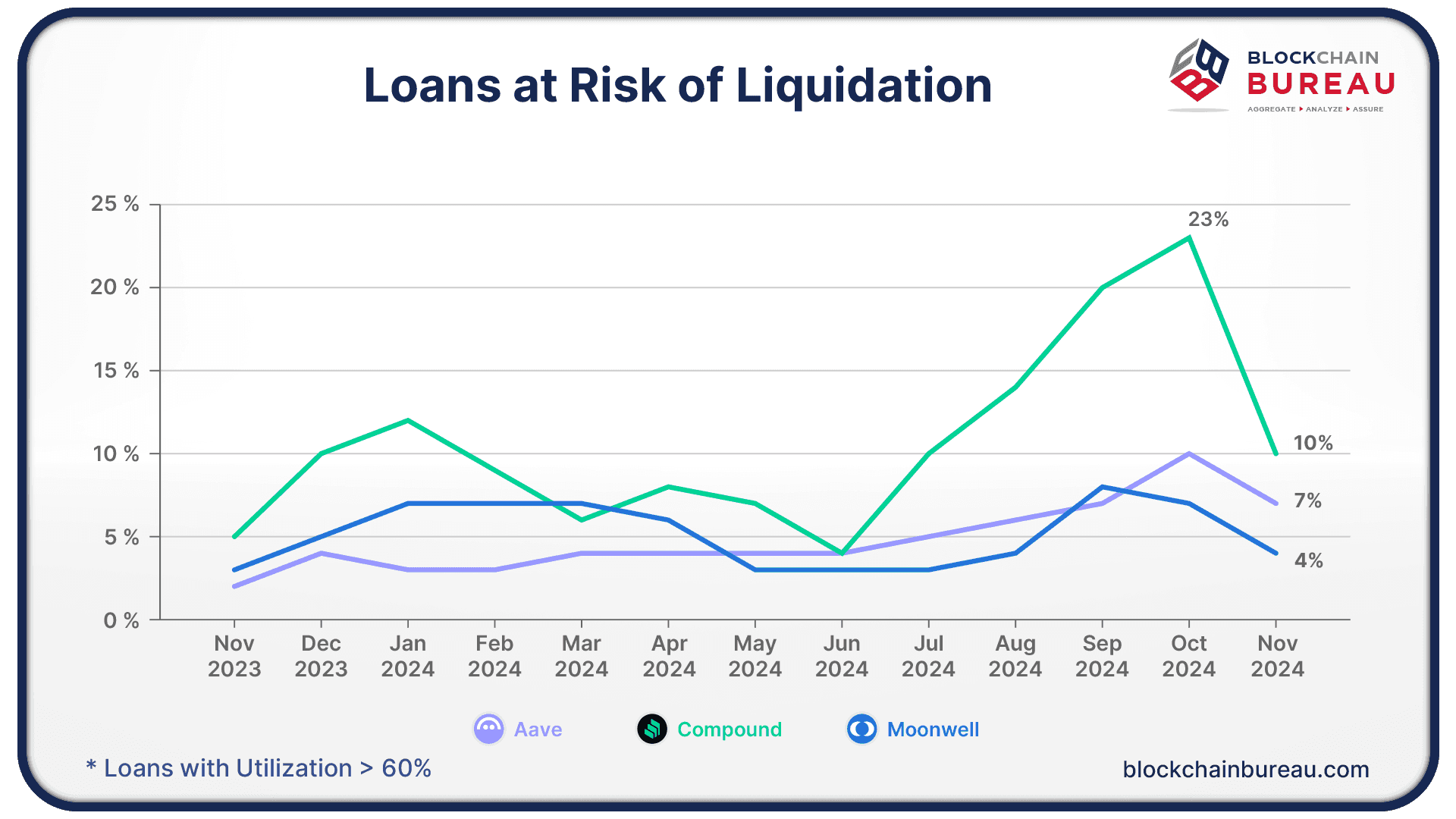

On average, Compound users exhibit higher delinquency rates, largely due to their reliance on volatile assets as collateral, such as non-stablecoins.

Since July, Compound users on BASE have shown a significant deterioration in credit health, with many moving into higher utilization positions - indicative of increased liquidation risk.

By the end of October, 23% of loans were classified as high risk of liquidation (>60% utilization). This culminated in a significant liquidation event in November, where 27% of loans were ultimately liquidated.

In contrast, protocols and users utilizing stablecoins as collateral are generally less exposed to liquidation risk.

At Blockchain Bureau, we are dedicated to fostering responsible and sustainable lending practices within the on-chain economy. Our comprehensive credit scoring suite helps protect users by offering actionable insights into risk management.

View our Post on X